While running any business, you must pay attention to accounting operations. You can either hire someone who can handle the company’s finances or do it yourself. It is okay if you choose to do all the work by yourself. But it is more complicated than it looks.

You must learn plenty of things about bookkeeping and understand methods to achieve your goals. When you begin, you may not have enough budget to hire staff. It is okay and normal with all the small-scale business owners. But before you handle all the stuff, make sure that you know enough about this field.

As a newbie, you need to research and learn things that you have never done. This write-up will help you know all the things that you should keep in your mind before managing the bookkeeping task by yourself. With enough knowledge and assistance, you can avoid making common mistakes.

1. Open an Account for Separating Personal and Company Expenses

You cannot make business-related transactions through your personal bank account. It is necessary to manage both accounts separately. When you begin a new company, opening a new account and making all the transactions with that account is essential. In this way, you can manage your income and expenses at the same time.

You can deposit capital funds in this bank account and use it for taxes, salaries, and other expenses. If you operate another account to handle business transactions, you will lose track, and it will be hard to manage finances. If the bookkeeping job is complicated, you can outsource bookkeepers Winnipeg services.

2. Organize Your Records

When you bookkeep your company account without professional help, you must take care of all the records. It is necessary to organize and maintain them regularly so that one can save time. You must keep the deadlines in your mind and pay all the taxes timely.

It is okay if you are too busy to deal with these things. But you need to get some time to sort out things and maintain all your daily records. You can easily open the book and receive the necessary information whenever you must check any record.

3. Keep Track of Your Expenses

If one is using different payment modes for transacting money, one can complicate the task of tracking expenses. No matter whether you are using a card, paying cash, or any mode, you must keep track of it. If required, you must keep all the bills online and offline to calculate your company’s monthly as well as annual expenses.

If any staff member is on a business trip, you must handle all the expenses and take care of reimbursements. You can maintain the budget and run your company perfectly when you keep track of your expenses.

4. Use Automated Solutions

Instead of doing all the operations through manual approaches, you must find automated solutions. You can use software to record relevant company data, calculate taxes, prepare annual expense reports, etc.

In this way, you can save too much time because an application will do all such jobs for you. Plenty of automated applications are available online, and you can buy them as per your requirement. You can save your efforts and execute all the operations with automated solutions.

5. Remember All the Deadlines

As a company owner, you cannot afford to forget tax or other expense deadlines. You need to remember them and pay all the taxes and bills when required. If you forget to do so, you need to pay more as a penalty. You can set reminders on your mobile phone or laptop to be reminded.

It is complicated to memorize every date and execute all the operations smoothly. But you can use technology to help you get the reminders. It can help you avoid several mistakes that many small-scale company owners make.

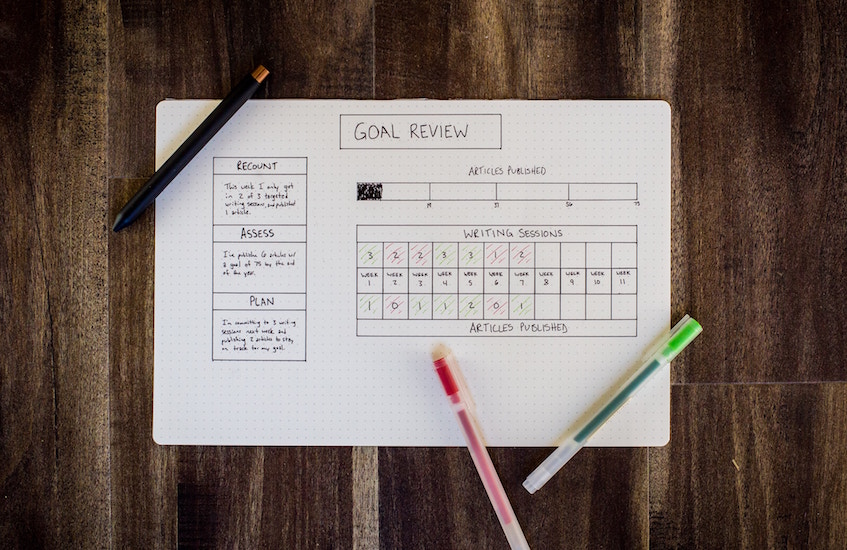

6. Set Your Priorities

While running any business, you can only deal with some things at a time. If you try to do so, you may confuse or execute operations incorrectly. Initially, you need to calm your mind and prepare yourself to do the work. Bookkeeping consists of many tasks, and you must set priorities.

You can decide how to schedule operations and handle complete finance work as per your preference. You can do this when you wake up and then, follow the whole-day schedule. Setting priorities may take a few minutes, and you can easily manage your work.

7. Leaving an Audit Trail

In accounting, it is necessary to leave traces so that one can step back and determine what you have done. It is a crucial thing to do for your company’s growth. You must understand more about the audit trail as it is a document for backing all the daily transactions you have already recorded in the book.

With the help of a trail, you can track all the company payments and verify them later. You can check all the expenses, like bills, salary details, quotes, etc. Using an audit trail, you can protect your company from fraudulent activities, enhance accuracy, and trace missing transactions. For every small-scale business, it is necessary to maintain the accounting records properly.

The Bottom Line

Anyone who is managing the accounting and bookkeeping work of a company must keep the listed things in his mind. It is not an easy job as it looks. One needs to be mentally prepared to take the burden and execute all the operations correctly and with dedication. If you keep all these things in your mind, you can avoid making mistakes and handle your finances correctly.

Initially, you cannot afford to hire staff to handle such a task; hence, you must do all the stuff yourself. But you can run your business properly if you know how to do it. Before you start doing anything, calm your mind and prepare a schedule to manage all the operations. Once you prepare yourself, you can go ahead and handle company finances.