Taxes are a necessary evil for businesses of all sizes. No matter how small your business, you need to be aware of the tax laws that apply to you so that you can make smart decisions when it comes to filing your taxes. In this article, we’re going to discuss some common mistakes small businesses make when it comes to taxes and how to avoid them.

Preparation is Key to Avoiding Tax Problems

Small businesses often make common mistakes when preparing their taxes, which can lead to big problems down the road. Here are six common tax mistakes small businesses make:

- Not understanding their income tax liability.

- Failing to accurately report their business income and expenses.

- Not filing correctly or at all.

- Making mistakes with deductions and credits.

- Not planning for potential future tax changes.

- Not having an accurate financial statement.

Understanding Your Business Income and Deductions

There are a few common mistakes small businesses make when it comes to their taxes. By understanding your business income and deductions, you can avoid some costly mistakes.

- Not counting all income: You may be undercounting your income if you’re not including all of your business income. This includes revenue from services, sales of inventory, and any other sources of income. If you’re not sure what counts as business income, talk to Manchester tax consultants.

- Not taking the right deductions: You can reduce your taxable income by taking appropriate deductions for expenses like rent, advertising, and employee payroll costs. Make sure you itemize your deductions if you’re eligible to do so.

- Failing to file taxes: If you don’t file your taxes by the deadline, you may owe penalties and interest on any unpaid taxes. You also could have to pay back any refunds or credits you received from the IRS. Don’t let this happen – get your tax filing done on time each year.

- Not knowing their filing status: Your business may be classified as either an individual or a corporation. Each has different tax rules that you need to know about in order to correctly file your taxes. If you’re not sure what category your business falls into, speak to a tax professional.

Keep Accurate Records

Small businesses make common mistakes when keeping accurate records, which can lead to unexpected tax consequences. Here are four tips for avoiding common tax mistakes:

- Keep accurate records of income and expenses. This includes tracking the source of income and all expenses, including those associated with providing services.

- File your taxes on time. Even small businesses can face late penalties if they don’t file their taxes on time.

- Track your deductions. Use a deduction estimator to find out how much you can deduct for specific expenses.

- Make sure you’re taking advantage of all available deductions and credits. Tax laws are complex, so it’s important to consult with a tax advisor to ensure you’re taking the most advantageous deductions and credits available to you.

Avoid Exploitative Debt Arrangements

Small businesses often fall victim to exploitative debt arrangements. These agreements can be very costly, and can lead to a lot of problems down the line. Here are some tips to avoid these types of agreements:

- Do your research. There are a lot of scams out there, and you don’t want to get caught in one. Make sure you understand the terms of the agreement before you sign it.

- Don’t take on too much debt. If you find yourself struggling to pay back your debt, it’s probably because you’re taking on too much debt. Consider borrowing only what you need, and make sure you have a solid plan for paying it back.

- Don’t let your lender pressure you into making changes to your business plans or taking on more debt. If something feels wrong, it probably is. Don’t take anyone’s word for it – ask for advice from a trusted source before making any decisions.

- Know your rights. If something goes wrong with your loan, know what your rights are – and stick to them! Your lender may not be willing to work with you if you don’t cooperate fully with their demands, so be prepared for that possibility.

File an Accurate Return

Small business owners often make common mistakes when filing their taxes. Here are a few to watch for:

- Filing an incorrect return. This can result in underreporting income, overpaying taxes, or even getting in trouble with the IRS. Make sure you file a correct return using the correct forms and instructions from the IRS.

- Not claiming all of your deductions and credits. Many small businesses qualify for special deductions and credits that can reduce their tax liability. Check with your accountant or the IRS to see which ones apply to your business.

- Ignoring tax penalties. Failing to pay your taxes on time can lead to costly penalties and interest charges. Don’t put yourself at risk – get started on your tax return as soon as possible to avoid any penalties.

- Not keeping adequate records. If you’re ever audited by the IRS, having accurate records will help prove your case. Make sure you keep track of all financial information, including sales figures, expenses, and profits.

- Misunderstanding tax laws. Even experienced business owners sometimes get confused about the complex tax laws governing their industry or business type. Get advice from a qualified professional if you have questions about your tax situation.

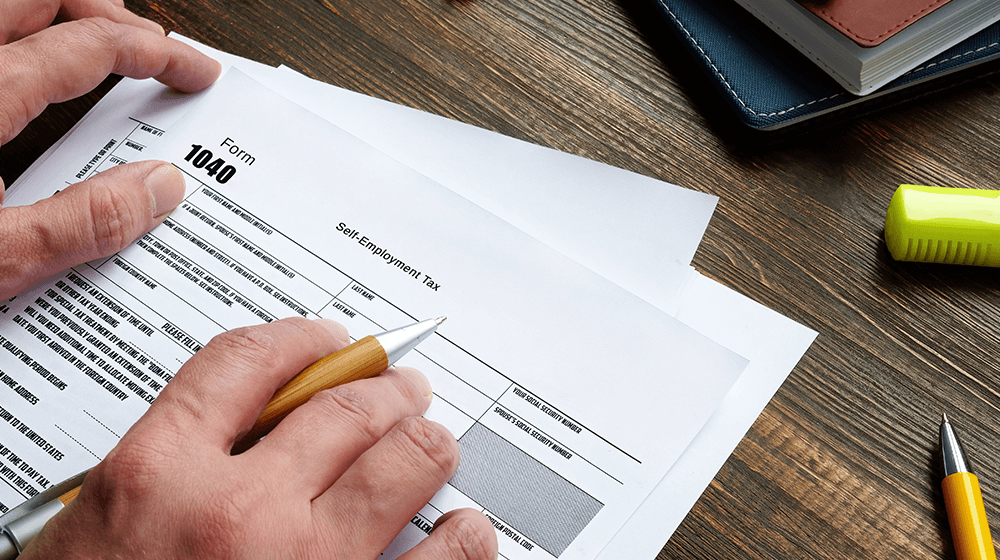

Learn About Self-Employment Taxes

Self-employment taxes are one of the most important taxes businesses owe. When you’re self-employed, you pay both the regular income tax and the self-employment tax. Here’s a quick guide to help you avoid common self-employment tax mistakes.

- Failing to track your business income and expenses. Businesses that fail to keep track of their income and expenses can end up with large amounts of self-employment taxes owed. This is especially true if your business makes irregular or infrequent income or if you have a lot of expenses that you don’t account for, like rent or marketing costs.

- Overpaying your payroll taxes. The employer portion of the self-employment tax is based on a worker’s wage base, which includes any tips they earn. If you underpay your payroll taxes, you may end up owing more in self-employment taxes than necessary. Make sure to withhold the correct amount from your employees’ wages each month to ensure accurate tax payments.

- Failing to report all business income and expenses on your tax returns. Taxpayers must report all their business income and expenses on their individual federal tax returns and on Form 1040S, Schedule C, and Form 1040EZ. Failure to report all income and expenses can lead to large tax bills and penalties.

- Taking advantage of special tax breaks available to self-employed individuals. Many self-employed individuals are eligible for special tax breaks, like the Archer Medical Tax Credit, the Expanded Child Tax Credit, and the Health Coverage Tax Credit. Make sure you’re taking advantage of all the tax breaks available to you to avoid overpaying your self-employment taxes.

Conclusion

If you own or manage a small business, it’s important to stay on top of the latest tax laws and regulations. Here are some common mistakes businesses make when it comes to taxes, and how to avoid them. Don’t let your business become an easy target for tax collectors — get ahead of the curve by staying informed about the latest changes in the law!